If conventional investing is “returns-first” then what does “mission-first” or mission driven look like?

What are the strategies we might use to help transition our money?

Distinct from conventional impact investing, I try to help us push into the leading edge of impact-first investing. The kind of asset stewardship that might lead toward a regenerative economy: something that seeks to boldly embody the call of our faith and wisdom traditions and seeks human and planetary flourishing.

More specifically, my hope here is to reflect on a few of the strategies I’m thinking about as I accompany Catholic institutional leaders.

Here’s a quick summary of the five strategies I will elaborate on:

- Restructure Business for a Livable Future. Read Not Fit-for-Purpose, Beyond Corporations, and Shifting Power to learn from human rights and multi-stakeholder communities.

- Find Funds that are Movement Aligned. Read about Social Movement Investing. Invest your money in places that are actually in authentic relationship with (and accountable to?!) social movement groups. If social and environmental aims really are your priority, then move your money into investments with fund managers / organizations that are authentically in relationship with social and environmental movement groups — or better yet, designed (and controlled) with them.

- Translate for your Investment Advisor. As you’ve probably experienced, most investment professionals won’t understand when you when you say you want to invest in the solidarity economy. Don’t shy away. Be confident and insistent. Bring them along the learning journey you’re on, or recognize they’re not going to be a fit and find one that is open to change. Consider advisors like ReValue that allow you to draw on their due diligence of alternative, impact-first investments, and pay a sliding scale fee based on the value you get from their work. Or learn from Chordata Capital, or if you’re an organization consider: Align Impact, Veris, FreshPond or Tiedemann. If you employee people, consider Green Retirement (Timothy Yee) for the 401k/403b or similar Simple IRA plan that you offer your employees.

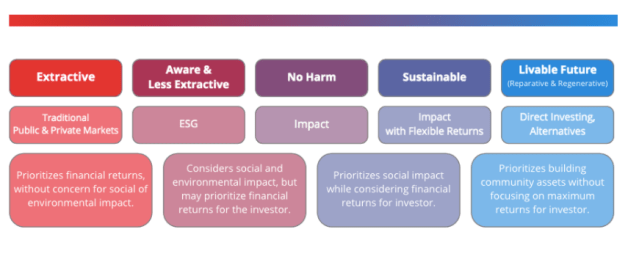

- Resist Capital Supremacy. Build Capital Solidarity. Read “A Spectrum: Extractive to Regenerative” from Justice Funders, which helps name a north star. Wherever you’re starting from, there are initial steps you can take. We’ve built off their framework and offer our “Finance-first” to “Faith-first” spectrum — with “Capital Reciprocity” being our definition of a faith-first approach. Capital Solidarity takes it a step further.

- Embrace Synodality: Build relationships with social movement leaders. Align yourself with those that are furthest from from the centers of power but within your sphere of tolerance so that you can authentically maintain the relationship over time. Consider the environmental movement. Or the movements for peace. What social movement leaders are you building or maintaining mutually accountable relationships with? Movement for Black Lives, 350.org, Movimento Sem Terra (MST / Landless Workers Movement in Brazil), the movements and community organizing groups that gathered for World Meeting of Popular Movements, or Ecclesial Movements like Focolare Movement, Sant’Egidio, or Economy of Communion. Synodality is the notion of walking together. How do we walk together in authentic relationship with movement leaders? Movements arise from the periphery. Our church’s current synod process encourages to go to the margins — the furthest reaches and listen to the people there. Read more at the Vatican’s Synod website. The preparatory document is quite good. More at synod.va.

1. Restructure Business for a Livable Future

Take 3 minutes to skim Not Fit-for-Purpose to learn from human rights and multi-stakeholder community leaders and how they reflect on the past couple decades of their work.

The Context: A key strategy for human rights and community leaders has been to engage business through “corporate resolutions” that shareholders file to create “multi-stakeholder initiatives” (MSIs).

One question that Amelia Evans and the team at MSI Integrity pose:

Is the influence of corporate resolutions that lead to multi-stakeholder initiatives waning?

Their key insights are revealing:

Their conclusion is blunt:

The lessons from our research into MSIs suggest that two major steps need to be taken in order to address corporate-related abuses and provide meaningful rights protection.

“1. Rethink the Role of MSIs

The appropriate role for, and limitations of, MSIs need to be more accurately articulated and understood.

Recognize that MSIs are not a substitute for public regulation.

2. Challenge the Corporate Form

We believe that the failure of MSIs is inextricably linked to the failures of the corporate form itself. “

In summary: we need to move Beyond Corporations.

Their new project: Shifting Power: Assessing Worker- and Community-Centric Alternatives to Conventional Corporations.

2. Find Funds that are Movement Aligned

Read about Social Movement Investing. In particular take a look at this chart:

What immediately stands out to me is how an investor divesting (from fossil fuels or private prisons) is at the bottom left when it’s not done in relationship with others. It’s vital to divest as part of a mass campaign — to do so in relationship to social movement leaders and to reflect the demands of popular movement uprisings.

Similarly, while patient capital for people of color and frontline entrepreneurs has a symbolic connection to what movement leaders are asking for, to be truly aligned and accountable, the patient capital fund needs to be designed by movement groups.

To appreciate a bit more what this might look like, let’s consider the difference between JP Morgan Chase’s Climate Change Solutions Fund and Carbon Collective.

- Carbon Collective starts their approach using the world’s leading resource for climate solutions: Project Drawdown. Carbon Collective has built and maintains a relationship to this climate solutions group that has broad-based respect by the scientific and environmental communities. They do a great job explaining their theory of change and their approach in this “Solving Climate Change: The Drawdown Index” article.

- More traditional climate solutions funds like JP Morgan Chase’s set their own frameworks for what their managers believe will lead to climate solutions. They don’t look to or maintain relationships with scientific or environmental movement organizations. Who do you want setting your priorities?

What I appreciate from this framework is the desire to be “movement aligned”

In Movement Alignment, we explore the process of building relationships between investors and social movements; ways that investors can leverage power as they deepen social movement relationships; structures for investor-movement coordination; and we introduce a typology for assessing how investments are (or aren’t) aligned with social movement strategies.

Distinct from conventional impact investing, Social Movement Investing strategies are co-created and coordinated with grassroots movements.

Center for Economic Democracy

To take the learning a bit deeper, we can look further at these three fund options:

- Candide Group’s Olamina Fund (~$40M private fund) is accountable to their Advisory Board of social movement leaders.

- Boston Ujima Project structures community control over their ~$5M patient, non-extractive debt fund (see investor report).

- Adasina Social Capital (~$100M public equities – social justice index fund: “JSTC”) works with social justice partners to create and release data about publicly traded companies that can help advance social movement goals. Their recent successes include: ending forced arbitration for sexual harassment and making it extremely difficult for private prisons to raise capital in public bond markets.

In particular, you might want to take a closer look Adasina’s ETF since it is accessible wherever you buy stocks. Just search “JSTC”.

3. Translate for your Investment Advisor: Act Confidently and Insist

When you meet with your financial advisor or chief investment officer, much of what we’re reviewing will be foreign. To help you with beginning to translate these mission-first opportunities into the “asset class” or types of investments your investment advisor will recognize, we put together this chart:

If you go deeper into any of these fund options, your investment advisor will likely tell you that they are too risky. They might say the (often Black or female) manager doesn’t have enough experience.

There is a reason for this.

Traditional due-diligence and risk-assessment frameworks in the asset management industry have led to a system in which white, male asset managers control 98.7% of the investment industry’s $69 trillion in assets under management.

Julie Segal, Harvard professor, quoted in Institutional Investor

Did you catch that?

White, male asset managers control 98.7% of assets under management

The traditional risk-assessment frameworks reinforce the status quo. If you’re interested in changing, one step to start with is to encourage your advisor to review and sign the Due Diligence 2.0 commitment

To take it a step further.Your job is to be clear that you want something different.

Your job is to develop your own conviction and confidence that we’re currently headed towards an unlivable future.

Conventional finance logic (and neoclassical economic theory that under-girds it) can’t comprehend that. It’s not designed to. But if you walk with the poor, or if you follow Jesus to the periphery, then you see, we need a new approach to investing. And that means seeing status quo investing as the riskier approach. You come to ground yourself in this perspective, because you’re choosing to value the life of people in Africa, India, Latin America, Selma as much as your own. You’re seeking to love your neighbor as yourself.

You’re seeing these “others” as part of the body of Christ and therefore worth the same human dignity. Therefore you’re not going to allow your investment advisor to convince you that untested, new, shorter track record investment products/ funds are too risky.

You are going to stand firm in your faith-first approach and offer your advisor the resources here to educate themselves on the emerging solidarity economy.

Another piece is that you might want to set your sights on a “regenerative portfolio” but in the near term, the most important thing is to take steps towards a “transitional portfolio” and away from the status quo extractive situation.

Recognize the transition takes time:

4. Resist Capital Supremacy. Build Capital Solidarity.

Skim “A Spectrum: Extractive to Regenerative” from Justice Funders, which helps name a north star.

Wherever you’re starting from, there are initial steps you can take.

We’ve built off their framework and offer our “Finance-first” to “Faith-first” spectrum — with “Capital Reciprocity” being our definition of a faith-first approach.

Capital Solidarity seeks to move as much of our portfolio from the left to the right. takes it a step further.

It might look something like this:

There is a growing field of investment advisors that can help you move your portfolio to align with a livable future.

Consider advisors like ReValue that allow you to draw on their due diligence of alternative, impact-first investments, and pay a sliding scale fee based on the value you get from their work.

Or learn from Chordata Capital.

Or if you’re an organization / institutional investor, consider: Align Impact, Veris, FreshPond or Tiedemann.

If you employee people, consider Green Retirement (Timothy Yee) for the 401k/403b/ Simple IRA plan that you offer your employees.

5. Embrace Synodality. Build Relationships with Popular Movement Leaders.

This is a journey.

We need to walk together.

Align yourself with those that are furthest from from the centers of power. But to be realistic, also consider your sphere of tolerance so that you can authentically maintain the relationship over time.

Consider the environmental movement. Or the movements for peace.

What social movement leaders are you building or maintaining mutually accountable relationships with?

- Laudato Si Movement,

- People’s Climate Movement,

- 350.org,

- Cooperative Movement in the US or internationally,

- Movimento Sem Terra (MST / Landless Workers Movement in Brazil),

- Movement for Black Lives,

- World Meeting of Popular Movements,

- New Economy Coalition, international Solidarity Economy movement,

- Ecclesial Movements like Focolare Movement, Sant’Egidio.

Synodality is the notion of walking together.

How do we walk together in authentic relationship with movement leaders?

Movements arise from the periphery.

Our church’s current synod process encourages to go to the margins — the furthest reaches and listen to the people there.

You can read more at the Vatican’s Synod website. The preparatory document is quite good.

Below I share a 30 second video clip from Bishop McElroy, Diocese of San Diego, where he says “”The Church is Synod”.

More on Synodality at synod.va or at Discerning Deacons.